texas estate tax return

Tax return is a form that is filed by all individuals with the minimum set income level as well as corporations estates trusts and partnerships and so on. Does Texas have an estate tax.

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

It only applies to estates that reach a certain threshold.

. If your address has changed please update your account. The gift tax return is due on April 15th following the year in which the gift is made. 20 The estimated tax should be paid by that date as well.

1 2016 to be filed electronically. Texas state and local governments generate revenue primarily from sales tax and property tax. You can also deduct.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. This page contains basic information to help you. Texas is one of seven states which do not levy a personal income tax.

31 rows Generally the estate tax return is due nine months after the date of death. Counties cities transit and special purpose districts have the option to impose additional local sales and use taxes. Based on Texas law if an estates value estate exceeds 114 million you need to submit.

Texas is one of seven states which do not levy a personal income tax. Residents of Texas must still file federal Form 1040 or Form 1040SR each year. 1 prepare sign and file.

If an estate is subject to estate tax someone will need to file Form 706 a federal estate tax return on behalf of the estate. The estate tax is reported on IRS Form 706 U. As the executor youre responsible for using the estates assets to pay off all the decedents.

Texas has a state sales tax rate of 625. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. An entity that has total annualized revenue less than or equal to the no tax due threshold of 1230000.

His assets were held in a living trust that became an irrevocable trust upon his death. Texas estate planning electronic resource With fingertip access to hundreds of forms along with explanations of how to best apply these forms Texas Estate Planning assists you in preparing client wills trusts durable powers of. For the 2022 report year a passive entity as defined in Texas Tax Code Section 1710003.

Real property tax is a system of taxation that requires owners of land and buildings to pay an amount of money based on the value of their land and buildings. Texas Tax Forms To expedite the processing of your tax returns please file electronically or use our preprinted forms whenever possible. There is a 40 percent federal tax however on.

In fact the average real property tax. Texas Tax Forms 2020. Estate and income tax returns.

It includes information on tracking estate planning documents final arrangements real estate and tax records. Form 4768 must be filed on or before the due date for Form 706 or for the equivalent form for a given estate. Final individual federal and state income tax returns.

It is one of 38 states with no estate tax. These tax rates can add up to 2 to the state sales tax making the combined total tax rate as high as 825 on purchased items. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related.

If circumstances make it impractical to file a reasonably complete federal estate tax return within the nine-month period an application for extension must be filed with the District Director for the IRS district in which the decedent. If you file in any month except December the estate has whats called a fiscal tax year instead of a calendar tax year. Only if the deceased person left a very large amount of propertyworth more than 1206 million for deaths in 2022will you need to file a federal estate tax return.

There are other taxes that the residents of the state have to pay and here is more detailed information on the account of forms dates and ways of tax return filing. One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax. The state repealed the inheritance tax beginning on September 1 2015.

Texas does not levy an estate tax. 2022 Texas Franchise Tax Report Information and Instructions PDF No Tax Due. What Is the Estate Tax.

The law requires all No Tax Due Reports originally due after Jan. Deceased Taxpayers Filing the Estate Income Tax Return Form 1041. Form 706 estate tax return.

The language conferring authority with respect to tax matters in a statutory durable power of attorney empowers the attorney in fact or agent to. All estates get a 600 exemption. Each are due by the tax day of the year following the individuals death.

A federal state local and foreign income gift payroll Federal Insurance Contributions Act 26 USC. That said you will likely have to file some taxes on behalf of the deceased including. The 1041 federal return was for the estate of my father who died in the middle of 2018.

What do you need to do to finalize an estate in Texas. So until and unless the Texas legislature changes the law which is always a possibility youll likely not owe any Texas inheritance or estate tax. The executor or administrator is required to among other things prepare and file all of the tax returns due both for the decedent and for the estate.

There is a number of tax return forms that vary. Filing Form 4768 automatically gives the executor of an estate or the trustee of a living trust an additional six months to file a tax return. Counties cities transit and special purpose districts have the option to impose additional local sales and use taxes.

31 rows Generally the estate tax return is due nine months after the date of death. Tax returns contain both the data about the money owed and the money a taxpayer might be entitled to get back. There are two kinds of taxes owed by an estate.

Most estates are too small to be subject to the federal estate tax. The tax period must end on the last day of a month. Estate tax also called the death tax applies to estates worth 1158 million or more.

On the federal level they are directed to the Internal Revenue Service IRS on the state level to appropriate state authoritiesTax returns are prepared using the forms of IRS. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs. Tax refunds are greatly relied on by the US.

All estates get a 600 exemption. A Closer Look The Matter of Texas Probate Taxes. For more information please visit the Texas Comptroller website.

You are required to file a state business income tax return in. Texas has the sixth highest real property tax rate in the US. Texas Estate Tax.

Youll definitely need expert help in preparing the federal estate tax return which is due nine months after the death. Texas does not have an income tax code. The state business return is not available in TurboTax.

You as executor can file the estates first income tax return which may well be its last at any time up to 12 months after the death. Texas ended its state inheritance tax return for all persons dying on or after January 1st 2005. It is due nine months from the date of the decedents death unless extended.

There are no inheritance or estate taxes in Texas. Chapter 21 and other tax returns. Near the end of the interview procedure TurboTax stated.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Texas Inheritance Laws What You Should Know Smartasset

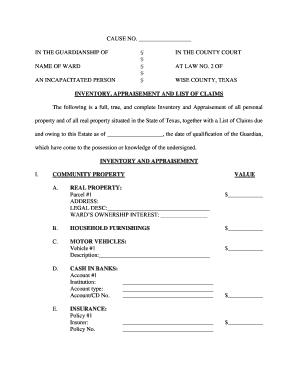

Estate Personal Property Inventory Form Unique Texas Inheritance Tax Forms 17 100 Small Estate Return Inheritance Tax Personal Property Job Letter

States With No Income Tax Map Florida Texas 7 Other States

What Is An Estate Tax The Turbotax Blog

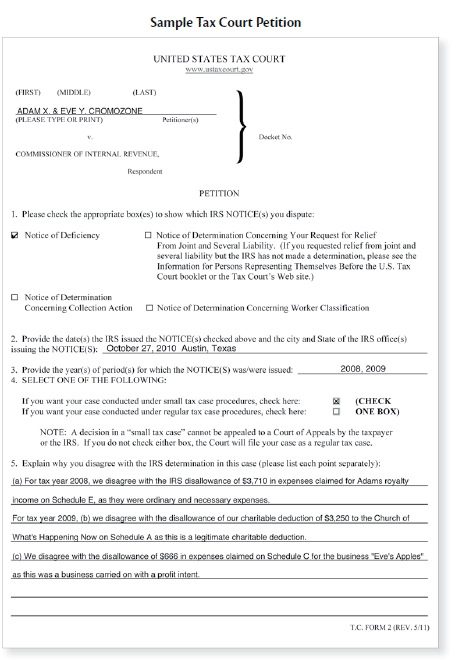

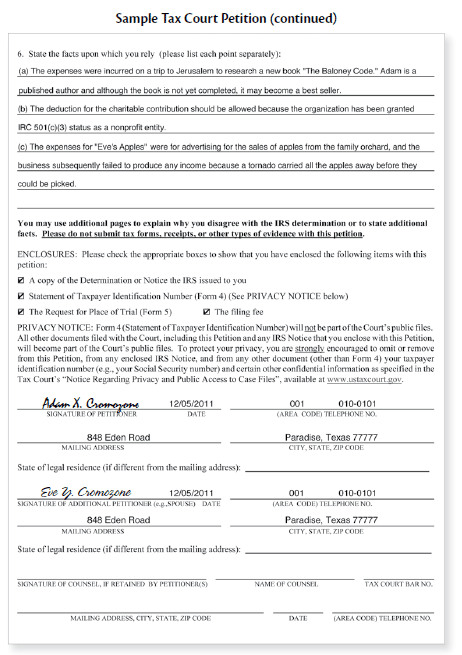

Irs Tax Court Standing Up To The Irs Law Offices Of Daily Montfort Toups

Texas Inheritance Laws What You Should Know Smartasset

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Texas Probate Inventory Form Fill Out And Sign Printable Pdf Template Signnow

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Cantrell Cantrell Pllc Home Page Texas Tax Attorneys

Irs Tax Court Standing Up To The Irs Law Offices Of Daily Montfort Toups

Texas State Taxes Forbes Advisor

Texas And Tx State Individual Income Tax Return Information

Ladybird Deed Texas 2022 Update Estate Planning Lawyer