hawaii fast food sales tax

Municipal governments in Hawaii are also allowed to collect a local-option sales tax that ranges from 0 to 05 across the state with an average local tax of 0431 for a total of 4431 when combined with the state sales tax. Living in paradise isnt cheap including when it comes to food.

Macfarms Fresh From Hawaii Coconut Macaroon Macadamia Nuts 6 Oz Walmart Com Coconut Macaroons Macadamia Nuts Macaroons

Based on income reported to the IRS in box 1 of W-2.

. Calculation to determine Hawaii use tax on taxes paid to State C. The average total salary of Fast Food Employees in Hawaii is 24000year based on 46 tax returns from TurboTax customers who reported their occupation as fast food employees in Hawaii. Hawaii does offer some relief in the form of a food tax credit for low-income residents.

With local taxes the total. A summary of state taxes including information on tax rates forms that must be filed and when taxes must be paid. Hawaii Sales of food are generally subject to Hawaii sales tax.

Base state sales tax rate 4. In almost all cases foods sold by food trucks will automatically qualify for the high rate ie. Hawaii Sales of food are generally subject to Hawaii sales tax.

B Three states levy mandatory statewide local add-on sales taxes. STATE SALES TAX RATES AND FOOD DRUG EXEMPTIONS As of January 1 2022 5 Includes a statewide 125 tax levied by local governments in Utah. Hawaii Sales of food are generally subject to Hawaii.

8625 New York City Sales Tax. Get a quick rate range. Free Unlimited Searches Try Now.

You can lookup Hawaii city and county sales tax rates here. The standard sales tax rate at that location. Booklet A Employers Tax Guide Rev.

Illinois Illinois has a high rate and a low rate when it comes to sales tax on food. Included in Sales Tax Base. Idaho Sales of food are generally subject to Idaho sales tax.

Included in Sales Tax Base. 808 933-0917 Hilo 808 322-1507 Kona Maui. Hawaii Fast Food Quick Service Restaurants - BizQuest has more Hawaii Fast Food Quick Service Restaurant for sale listings than any other source.

Most transactions of goods or services between businesses are not subject to sales tax. Idaho Sales of food are generally subject to Idaho sales tax. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases.

Reference sheet with Hawaii tax schedule and credits. Outline of the Hawaii Tax System as of July 1 2022 4 pages 405 KB 712022. Increase in the County of Kauai Fuel Tax.

Businesses Franchises Asset Sales Start-Up Businesses Real Estate. From consenting TurboTax customers. Capital Goods Excise Tax Credit.

4 Food sales subject to local taxes. This page provides an overview of. Total rate range 4-45.

Ad Lookup HI Sales Tax Rates By Zip. Learn about Hawaii tax rates for income property sales tax and more to estimate what you owe for the 2021 tax year. Hawaii state income tax rates range from 14 to 11.

Based on 46 income tax records 17000 41500. Utilities used for air conditioning cleaning heating and lighting are taxable but utilities used for cooking and water served to customers eg as water coffee tea soup etc are exempt. The maximum local tax rate allowed by Hawaii law is 05.

Increase in the County of Hawaii Fuel Tax. In 1950 the average American household spent 206 percent of their disposable income on food. 2021 58 pages 452 KB 9132021.

Georgia Prepared foods are taxable in Georgia though there are some exemptions for food in a school setting. Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates. Though Hawaii technically doesnt have sales tax it has a 4 General Excise Tax that is charged to businesses which typically pass that cost on to customers plus local taxes.

3 Tax rate may be adjusted annually according to a formula based on balances in the unappropriated general fund and the school foundation fund. Hawaii state sales tax rate range. Included in Sales Tax Base.

Sales of alcoholic beverages that are subject to the states 10 percent drink tax are exempt from sales and use tax but sales of 32 beer are taxable. 31 rows The state sales tax rate in Hawaii is 4000. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax.

General Excise Tax Imposed on Sales to Fast Food Retailers. Local rate range 0-05. Illinois Food prepared for immediate consumption is taxable.

Buy or sell your Hawaii Fast Food Quick Service Restaurant with BizQuest the Original Business for Sale Website.

Food And Beverage Louisvilleky Gov

Pin By Bryan Gissiner On Vision Board Stuff Buckeyes Jeep Vision Board

Vegan Food Near Me Native Foods

Sunmile Electric Meat Grinder And Sausage Maker 1hp 1000w Max Stainless Steel Cutting Blade And 3 Grinding Plates 1 Big Sausage Staff Maker White

Mountain Trees Sign Custom Metal Sign Cabin Sign Outdoor Weatherproof Sign

Pin By Agus On Flores Homescreen Wallpaper Cartoon Wallpaper Cartoon Wallpaper Iphone

This No Frills Fish Market On The Oregon Coast Belongs On Your Bucket List Beach Fishing Oregon Fresh Fish Market

Human Touch Certus Massage Chair Sun Sōfhyde

Map Of The United States Of America With Famous Attractions

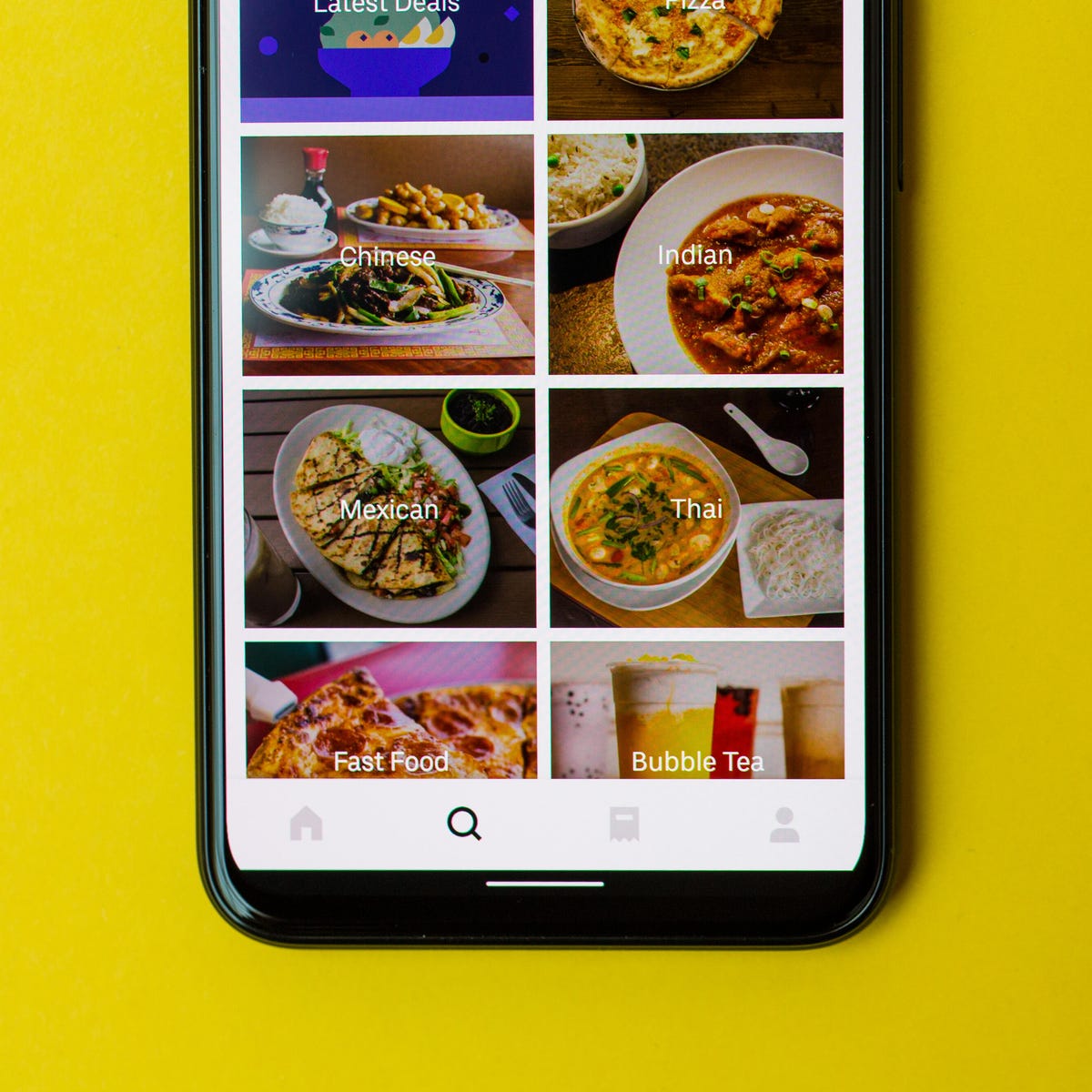

Best Food Delivery Service Doordash Grubhub Uber Eats And More Compared Cnet

520n M Brushless Cordless 3 8 Impact Drill Driver 25 3 Levels For Makita 18 21v Battery

Bendt 3 Tier Iron Fruit Basket Reviews Crate Barrel Tiered Fruit Basket Basket And Crate Fruit Basket

1428 Nicholson Houston Tx 77008 Houston Houses Estate Homes Home

Dining Services St John S University

31 Crazy Fast Food Menu Items You Can Only Get In Japan